Tax help for digital nomads & expats

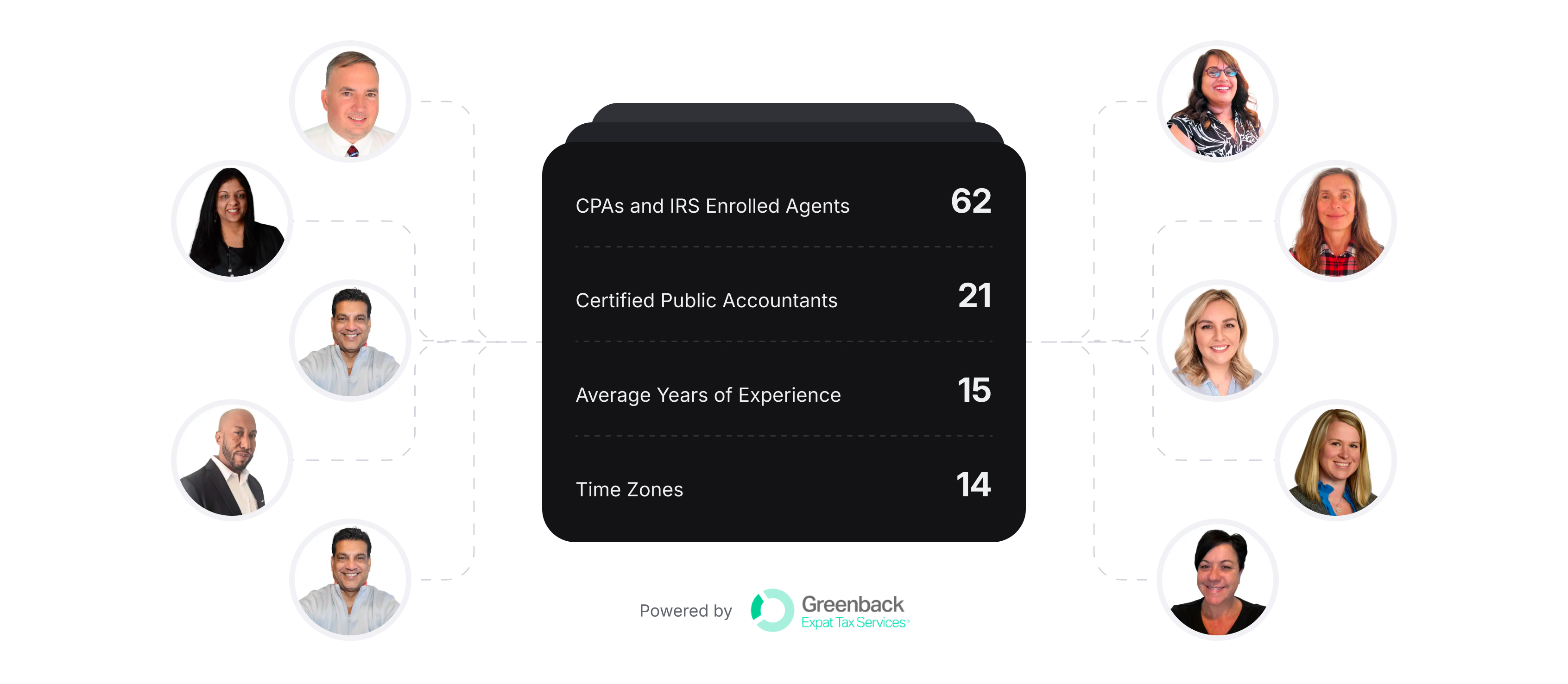

We boast an expanding global network of tax advisors ready to assist you in navigating tax regulations across borders.

Talk with a tax expert

Get a quote or set up a call with a tax expert to get started right away.

Get Personalized Recommendations

We'll provide personalized recommendations and guide you in any further steps to take.

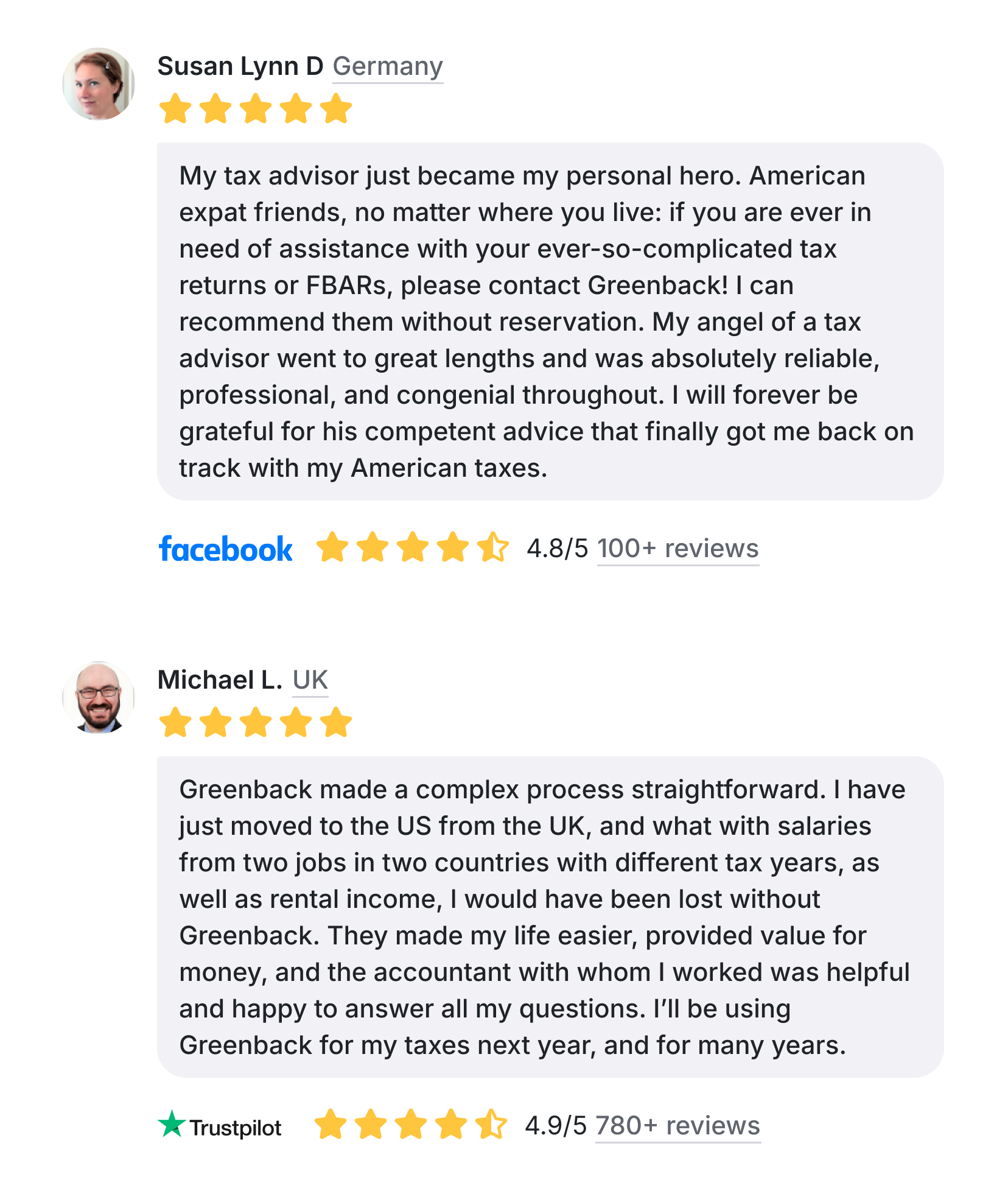

We deliver results

Read what our satisfied clients have to say about their positive experiences using our services.

Enjoy All The Benefits With Premium!

Looking for help with other things on your journey? Check out Citizen Remote Premium!

Get the full Social experience

Premium users can post and comment within the community.

Limitless Messaging

Send outgoing messages and create group chats.

Explore Further

Discover even more details and user reviews for each country!

Enjoy The Journey

No holding back: collect unlimited stamps and save all your memories!

Endless Love Coming soon

Get your unlimited Dating swipes to find that special someone!

Join The Events Coming soon

Get full access to events and become a host of your own parties!

And even more!

Get ready for more upcoming features and new adventures!

Frequently asked questions

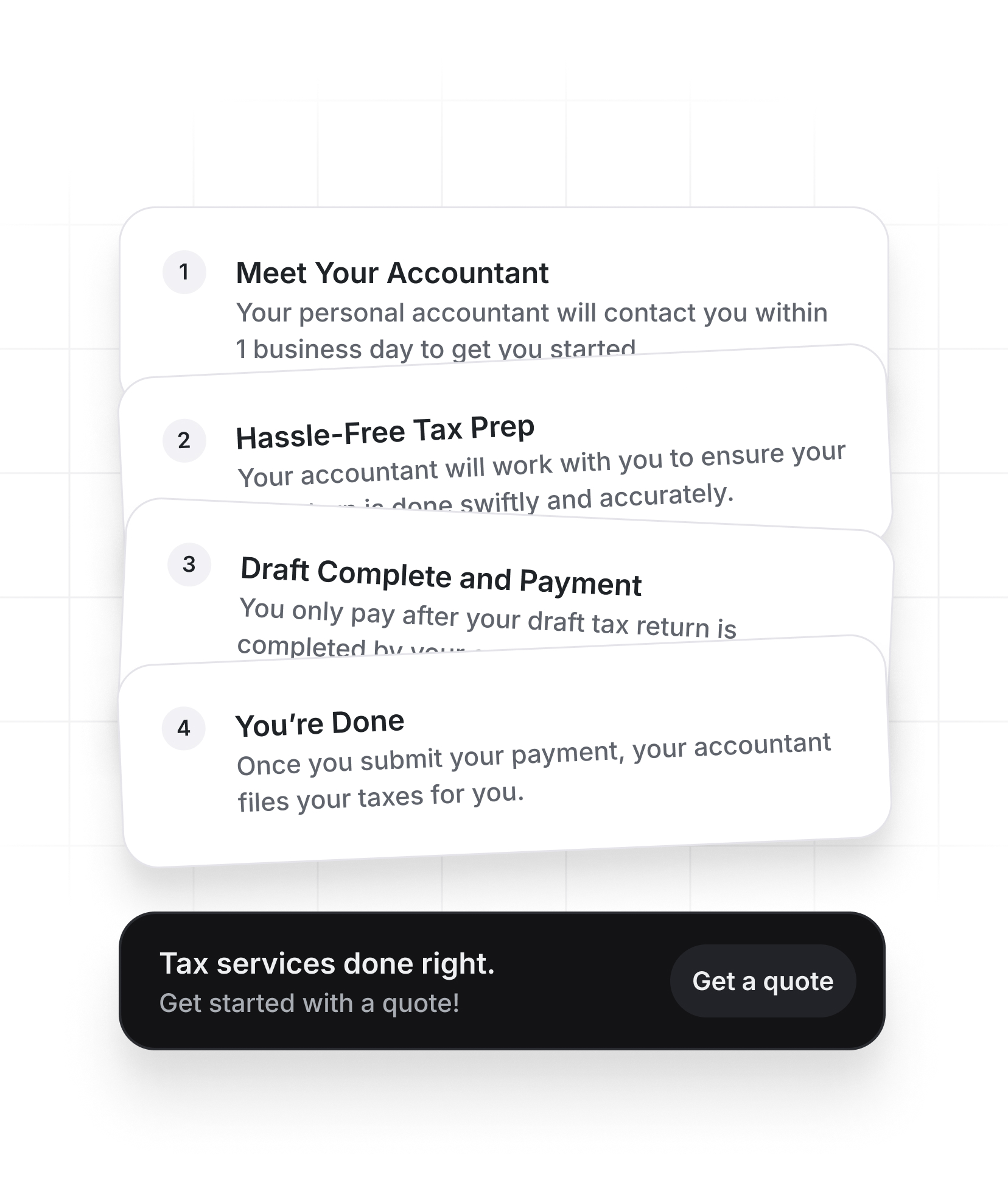

How does it work?

Please select your country on this page for assistance. We'll promptly connect you with a suitable advisor to address your needs.

Is this only for Americans?

Nope! We're continuously expanding our network of international partners and tax advisors! Whether you need assistance filing taxes in the US, UK, Canada, or numerous countries across Europe and beyond, we've got you covered.

What should I do if I need to file tax returns across multiple countries?

The advantage of Citizen Remote's tax services lies in our global network! We can assist you with filing taxes in your home country and/or abroad.

Can I file my taxes online, or do I need to visit an office?

All our tax preparation services and partners provide secure online filing options. Online filing offers numerous conveniences for global citizens. However, if you prefer face-to-face interaction, some of our partners offer in-person consultations, while all our team is available for video consultations upon request.

What should I do if I have income from multiple sources or from overseas?

You're required to report all sources of income, including foreign income. It's important to accurately report this information, and our tax professionals can assist you in doing so correctly.

Can I file my taxes myself, or should I hire a professional?

Whether you should file taxes yourself or hire a professional depends on your comfort level with tax laws, the complexity of your financial situation, and your willingness to research and stay updated on tax regulations. If taxes seems too complex or time consuming, we can certainly take the burden off your shoulders!

What if I made a mistake on my tax return?

If you realize you made a mistake on your tax return, you can file an amended return to correct it. It's important to rectify errors as soon as possible to avoid any potential penalties or interest.

How can I ensure that I'm maximizing my tax deductions and credits?

Keeping detailed records of your expenses, staying informed about changes in tax laws, and consulting with a tax advisor are effective ways to ensure you're taking advantage of all available deductions and credits.